Creating a monthly family budget is a crucial step towards achieving financial stability and meeting your financial goals. However, many families struggle to create a budget that actually works for their unique circumstances. In this comprehensive guide, we’ll walk you through the process of creating a monthly family budget that suits your needs and helps you take control of your finances. From setting goals to tracking expenses, we’ve got you covered!

Assess Your Financial Situation

Assessing your financial situation is the first crucial step in creating a monthly family budget. This involves taking an in-depth look at your income, expenses, and overall financial health. By understanding where your money is coming from and where it’s going, you can make informed decisions about budgeting and financial goals.

Calculate Your Income

To create an effective budget, start by calculating your total monthly income. This includes all sources of income for your family, such as salaries, wages, bonuses, freelance work, or any other regular income streams. If your income varies from month to month, it’s helpful to calculate an average based on past earnings.

Be sure to include all sources of income, whether they are from full-time jobs, part-time jobs, or side gigs. By accurately assessing your income, you’ll have a clear picture of the funds available to allocate towards expenses and savings.

Determine Your Fixed Expenses

Fixed expenses are recurring expenses that remain relatively constant each month. These expenses are essential and typically have set due dates or amounts. Examples of fixed expenses include rent or mortgage payments, loan repayments, insurance premiums, utility bills, and subscriptions.

Identify and list down all your fixed expenses, ensuring you include every recurring payment. It’s crucial to be thorough and accurate in this step to ensure your budget accurately reflects your financial commitments. Fixed expenses are a critical component of your budget as they form the foundation for allocating funds towards other categories.

Identify Your Variable Expenses

Variable expenses are costs that fluctuate from month to month and are often discretionary in nature. They include expenses that you have more control over and can adjust based on your financial priorities. Variable expenses may include groceries, dining out, entertainment, clothing, transportation, and miscellaneous expenses.

To identify your variable expenses, track your spending for a few months and categorize your expenditures. This can be done manually or by utilizing budgeting apps or expense tracking tools. Analyzing your past spending patterns will help you understand where your money is going and identify areas where you can potentially reduce expenses.

Once you have a clear idea of your variable expenses, you can assign reasonable limits or targets for each category in your budget. This allows you to make conscious decisions about how much you allocate towards discretionary spending while still staying within your overall financial goals.

By assessing your financial situation, calculating your income, determining fixed expenses, and identifying variable expenses, you gain valuable insights into your financial landscape. These steps provide a solid foundation for creating a comprehensive and realistic monthly family budget. Remember, a thorough understanding of your financial situation is key to effective budgeting and achieving long-term financial stability.

Set SMART Financial Goals

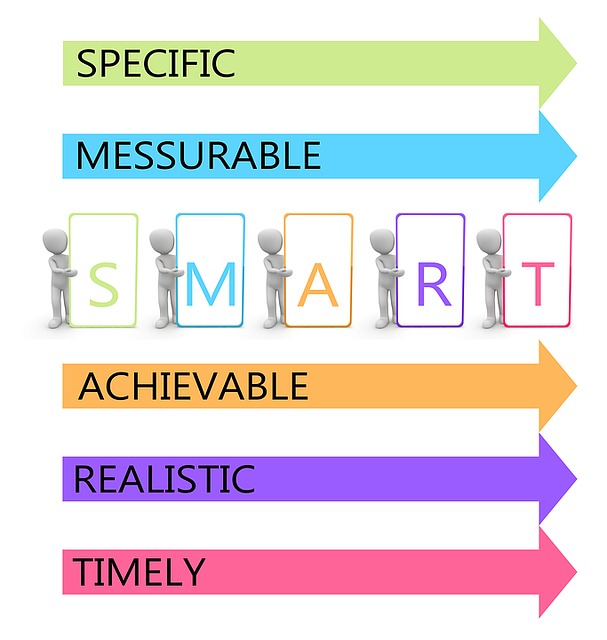

Setting SMART financial goals is essential for creating a monthly family budget that is effective and meaningful. SMART is an acronym that stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Let’s explore each component in detail:

Specific

When setting financial goals, it’s important to be specific about what you want to achieve. Instead of setting a general goal like “save money,” specify the amount you want to save or the financial milestone you want to reach. For example, “Save $500 per month for a family vacation” or “Pay off $5,000 in credit card debt within one year.”

Measurable

Your financial goals should be measurable so that you can track your progress. Measurable goals provide a clear indicator of when you have achieved them. For example, if your goal is to build an emergency fund, specify the desired amount, such as “Save $5,000 in an emergency fund within six months.” This way, you can easily track how close you are to reaching your target.

Achievable

Ensure that your financial goals are realistic and attainable. While it’s great to dream big, setting goals that are too far-fetched can lead to frustration and disappointment. Consider your current financial situation, income, and expenses when setting goals. It’s better to set smaller, achievable goals and gradually work towards bigger ones as you make progress.

Relevant

Your financial goals should align with your overall financial objectives and priorities. Consider the broader context of your family’s financial situation and what matters most to you. For example, if your priority is to save for your child’s education, focus on goals related to education savings rather than unrelated expenses.

Time-bound

Setting a timeline for achieving your financial goals adds a sense of urgency and helps you stay on track. Specify a deadline or target date by which you aim to accomplish each goal. For instance, “Save $1,000 for a down payment on a new car within one year.” A specific timeframe creates a sense of accountability and motivates you to take consistent action.

By setting SMART financial goals, you transform vague aspirations into clear, actionable targets. This approach ensures that your goals are well-defined, measurable, attainable, relevant, and time-bound. It provides a roadmap for your budgeting efforts and helps you stay focused on what truly matters to your family’s financial well-being. Remember to regularly review and adjust your goals as needed to stay aligned with your evolving financial circumstances and priorities.

Track Your Expenses

Tracking your expenses is a crucial step in creating a monthly family budget. It allows you to gain a comprehensive understanding of your spending habits and enables you to make informed decisions about where to allocate your money. Here are some key aspects to consider when tracking your expenses:

Monitor Your Spending: Start by diligently recording every expense you make. This includes both small and large purchases. Keep track of cash transactions, debit or credit card payments, and online purchases. It’s important to capture all expenses accurately to get a complete picture of your spending habits.

One way to monitor your spending is to keep a spending journal or use a dedicated budgeting app or spreadsheet. Make it a habit to record your expenses promptly, ideally on the same day or soon after making the purchase. This helps ensure accuracy and prevents any expenses from slipping through the cracks.

Categorize Your Expenses: Categorizing your expenses is an effective way to analyze your spending patterns and identify areas where you can potentially cut back or make adjustments. Create categories that align with your spending habits and financial goals. Common expense categories include groceries, housing, utilities, transportation, dining out, entertainment, and personal care.

Assign each expense to the appropriate category when recording it. This categorization provides a clear overview of where your money is going and helps you identify any spending trends or areas of concern. It also makes it easier to allocate funds in your budget based on these categories.

Utilize Expense Tracking Tools: Take advantage of technology to simplify the expense tracking process. Budgeting apps and software offer convenient ways to track and categorize your expenses automatically. These tools can link to your bank accounts, credit cards, and other financial accounts to import transaction data directly. They can also generate reports and visualizations to give you a comprehensive view of your spending.

Popular expense tracking apps include Mint, PocketGuard, YNAB (You Need a Budget), and Personal Capital. Explore different options to find an app or tool that suits your preferences and offers the features you need. Remember to choose a secure and reputable platform to ensure the safety of your financial data.

Using expense tracking tools not only saves time but also provides valuable insights into your spending habits. You can easily identify areas where you may be overspending or discover potential savings opportunities.

By actively monitoring your spending and categorizing your expenses, you gain a clear understanding of where your money is being allocated. This information is crucial for creating an effective budget that aligns with your financial goals. Remember, tracking your expenses is an ongoing process, so make it a habit to regularly review and update your expense records to stay on top of your finances.

Creating a monthly family budget doesn’t have to be overwhelming. By following these steps and utilizing the right tools, you can develop a budget that aligns with your financial goals and works for your family’s unique needs. Remember, consistency and regular review are key to maintaining a successful budget. So, take charge of your finances, track your expenses diligently, and watch your financial dreams become a reality!

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. It’s important to personalize your budget based on your specific financial situation and consult with a qualified financial professional for tailored guidance.